Consumer credit remains strong, but for how long?

Analysing consumer credit data and carefully monitoring trends of underlying key economic performance indicators is an important part of what we do. We’re continuing to use our data to measure how the New Zealand market is responding to the challenges of Covid-19 now and in the future. Here’s the latest.

Healthy Economic Indicators

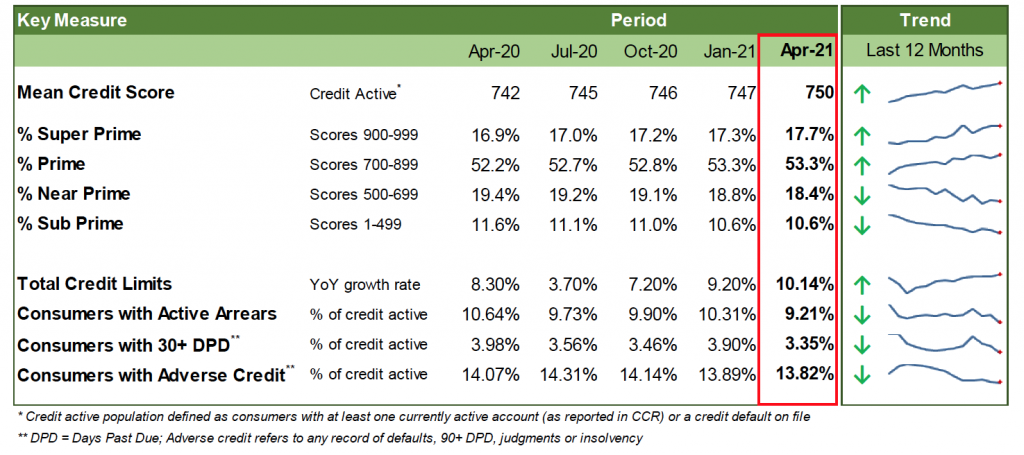

Driven by record low interest rates, consumers have been continuing to borrow high levels of credit in both 2020 and 2021. During the past year, average credit scores have steadily improved – with the number of New Zealanders having a prime or super prime credit score increasing from 69.8% to 71%

At the same time, the number considered to be sub-prime has fallen from 11.6% to 10.6%. This indicates individuals have been able to manage their finances, at least in the short-term, despite the economic uncertainty caused by the pandemic.

The average overall credit score in New Zealand now sits at 750, while the average credit score for new credit applicants is 649, an indicator of a strong economy and high consumer confidence.

Credit Active Population Trends

Inflationary Pressure on the Horizon

Inflationary Pressure on the Horizon

The current conditions we’re seeing may not continue indefinitely. We are now beginning to see early signs of inflationary pressure on the horizon, and the Reserve Bank is signalling the need to start increasing interest rates from next year.

Inevitably, this may hit borrowers in the back pocket as they face higher interest rates. While most borrowers will be able to absorb moderate increases, any rapid rises will dampen both credit demand and consumer spending, while likely to also see arrears and hardship levels increase.

What does this mean for you?

There may be a potential impact on consumer credit. We’re already seeing an increase in the number of customer accounts in hardship, reaching 12,520 in May 2021, with two-thirds of hardships related to mortgages and credit card accounts.

As latest figures show that 65% of mortgages are on fixed rate terms of one year or less, next year’s possible interest rate rise could leave most New Zealand mortgages vulnerable to increasing debt stress as repayment costs increase.

What can you do?

We will be watching and analysing these consumer credit indicators closely to measure the health of the market as the economy moves to the next phase of its recovery.

It’s difficult to plan when you don’t know what’s coming but we’ve got our finger on the economic pulse and the tools to measure it.

We will do our best to give you, our customer the information you need, when you need it to keep abreast of the changes. For more frequent updates and insights follow us on LinkedIn.