Running credit checks on any prospective customers can be beneficial to your business, as it helps you to identify and manage risk. This is particularly true when your customers are other businesses, as the amount of credit you extend is likely to be much higher than to a consumer.

Businesses with high credit scores are 15 times more likely to pay you than a company with a low credit score, yet only one in 10 Kiwi companies regularly credit check their customers, instead relying on trust and personal guarantees to manage risk.

Business credit reports are a reliable way for your company to determine a potential business customer’s creditworthiness. A business with a high credit score is far more likely to pay bills on time than a company with a low credit score, so having this information in advance can help you to decide which customers to extend credit to and protect your cashflow.

Running business credit checks can also help you to set appropriate terms of trade for each new customer. Having access to a business’s credit score will help you determine the risk of extending credit and set appropriate limits and terms in place.

You can also run credit checks on potential suppliers, to help determine their potential longevity. A low credit scores is a sign a potential supplier may not go the distance, leaving you with supply chain and operational issues if you are relying on their products.

If your company is considering a merger or acquisition with another company, the company’s credit report will give you crucial information that will help you to value the company. A high credit score will make any business more valuable, as it will transfer to the business buyer.

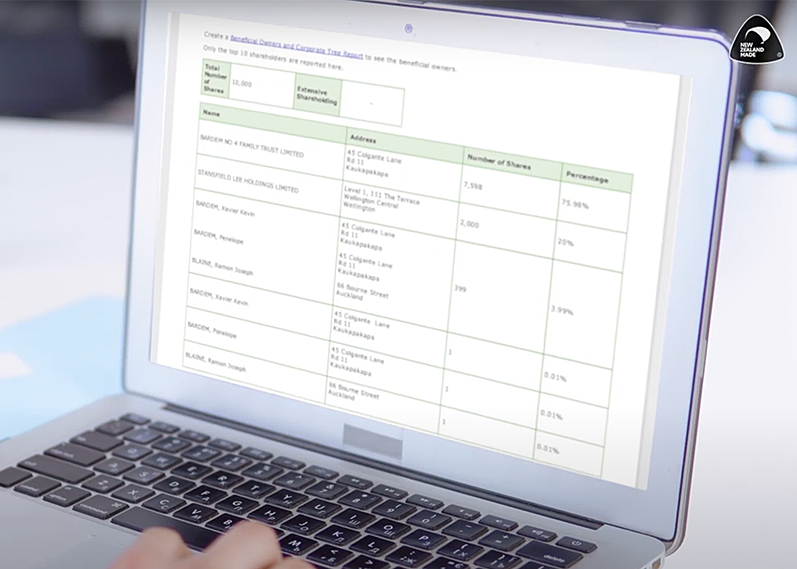

Other business checks can also be helpful before entering into a new trade agreement. For example, Beneficial Owners reports help you to cut through complex company ownership structures, identifying the ultimate beneficial owners and assisting compliance with AML legislation. The corporate family tree provides a visual of the multi-layered company structure.

Personal Properties Security Register (PPSR) checks can help you manage security interests and improve your chances of recovering debt by registering your security interests.

It’s also useful to run regular credit checks on your existing customers, to identify any changes in their credit score or financial position such as missed payments, declining credit scores or hardship indicators. You can set up tailored alerts for your customers to monitor changes as they happen and avoid risk to your cash flow.

Running regular portfolio healthchecks makes monitoring risk easier. It compares your entire portfolio’s performance against a wide range of key indicators pulled from datasets across multiple industries.

Cost-effective credit checking

You can access business credit reports for New Zealand companies you’re looking to trade with online from Centrix, through a simple self-serve portal or API integration These reports contain up-to-date information about the payment history of most companies actively trading in New Zealand and a business credit score, which is a summary of the information in the report.

A range of comprehensive reports are available through the same portal: Beneficial Ownership Checks, Personal Properties Security Register, and Alert Monitoring.

To find out more visit https://www.centrix.co.nz/get-reports or contact us to find out how we can help.