The latest GDP figures from June 2023 officially put Aotearoa New Zealand into recession, with two consecutive quarters of downward GDP recorded.

Additionally, the Official Cash Rate (OCR) increased to 5.5% in May 2023, which has seen interest rates climb while the cost-of-living squeezes household budgets.

However, many economists believe this will be the height of the OCR hikes, with the Reserve Bank expected to hold at this level for the remainder of 2023 to help rein in inflation.

Despite this, there is some evidence pointing towards Kiwi households potentially starting to acclimatise to this new norm.

Improving arrears recorded in April

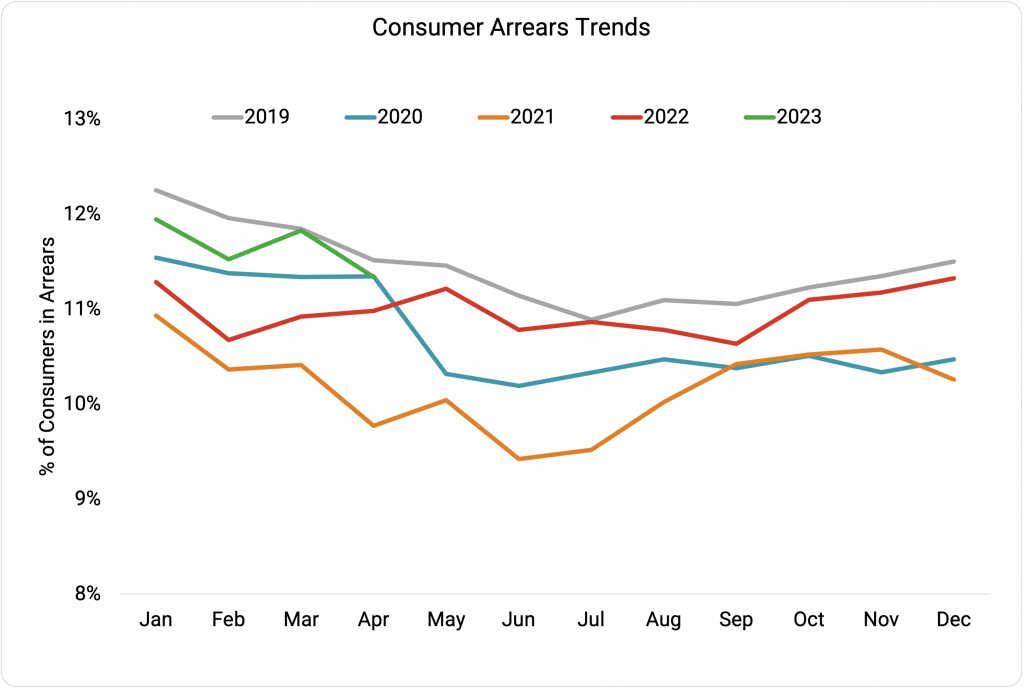

Overall consumer arrears fell slightly to 11.3% of the active credit population in April 2023, aligning to seasonal trends, after climbing to 11.8% in March 2023. Overall, there were 411,000 people behind on payments in April 2023, compared to 427,000 in March 2023.

The current arrears level is 4% higher year-on-year when compared to April 2022, but overall is still at historically low levels.

4.7% of active credit consumers are currently 30+ days past due in April 2023, up from 4.0% in April 2022.

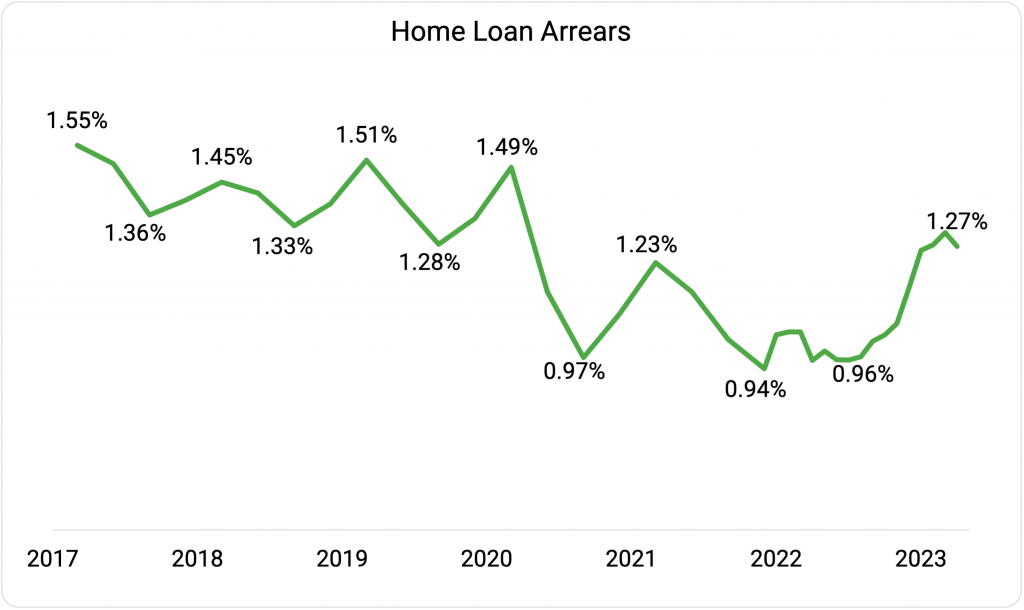

In an encouraging turn of events, home loan arrears saw a downturn in April 2023 after eight consecutive months of climbing – down to 1.27% with 19,000 mortgages reported past due.

However, this is still up 25% year-on-year as consumers continue to face financial challenges in the current economic climate. It’s also important to note that one month change does not equal a trend and we will be keeping a close eye on mortgage arrears for the remainder of the year.

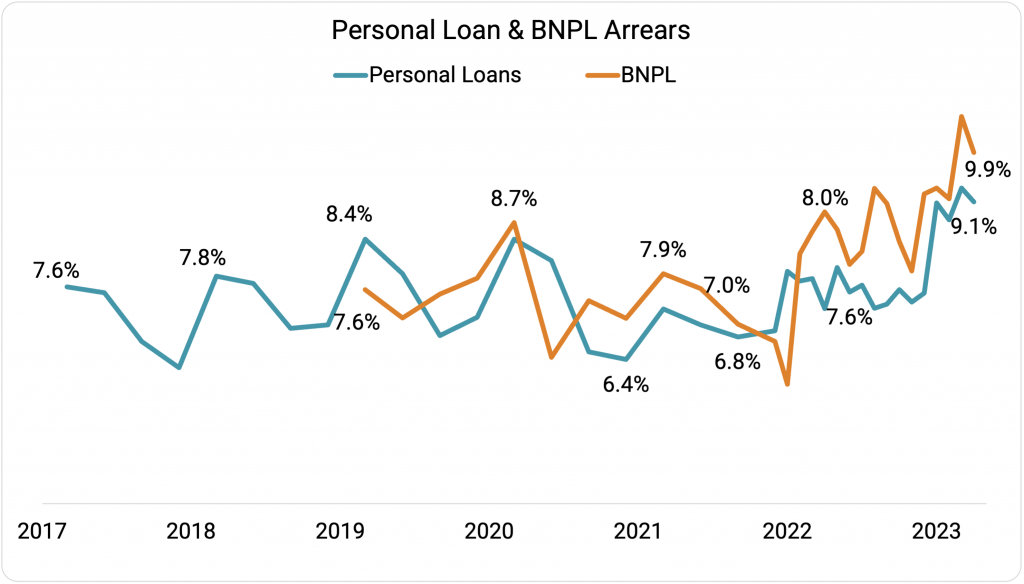

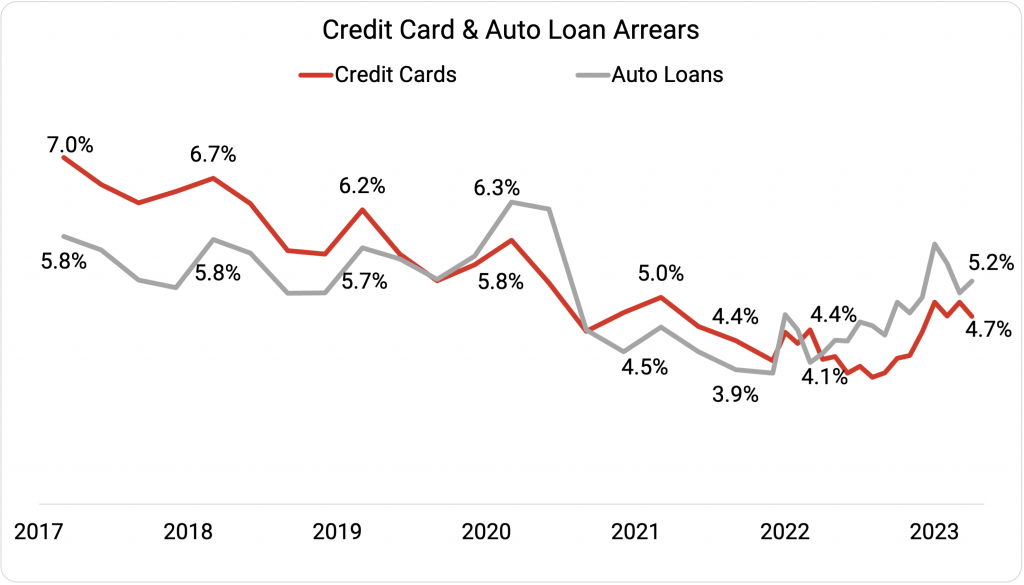

Buy Now Pay Later, credit card and unsecured personal loan arrears also fell in April 2023 – down to 9.9%, 4.7% and 9.1% respectively.

This shift could point towards Kiwi households beginning to adjust to the current economic climate and manging to get their repayments back under control.

However, arrears for vehicle loans increased in April 2023, up to 5.2% month-on-month and up 24% on a year-on-year basis.

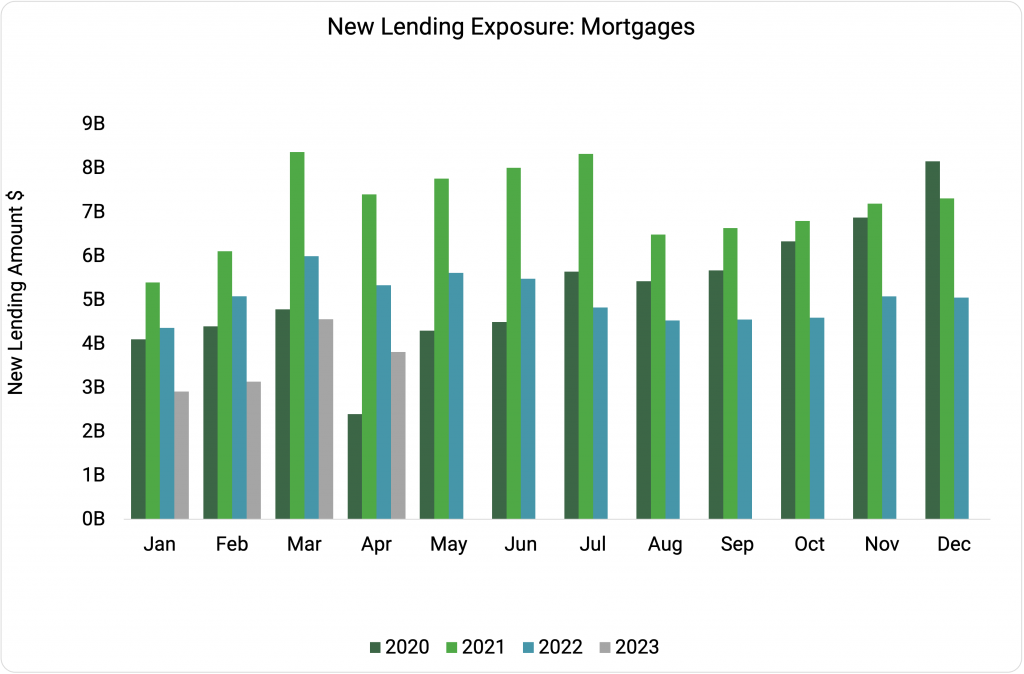

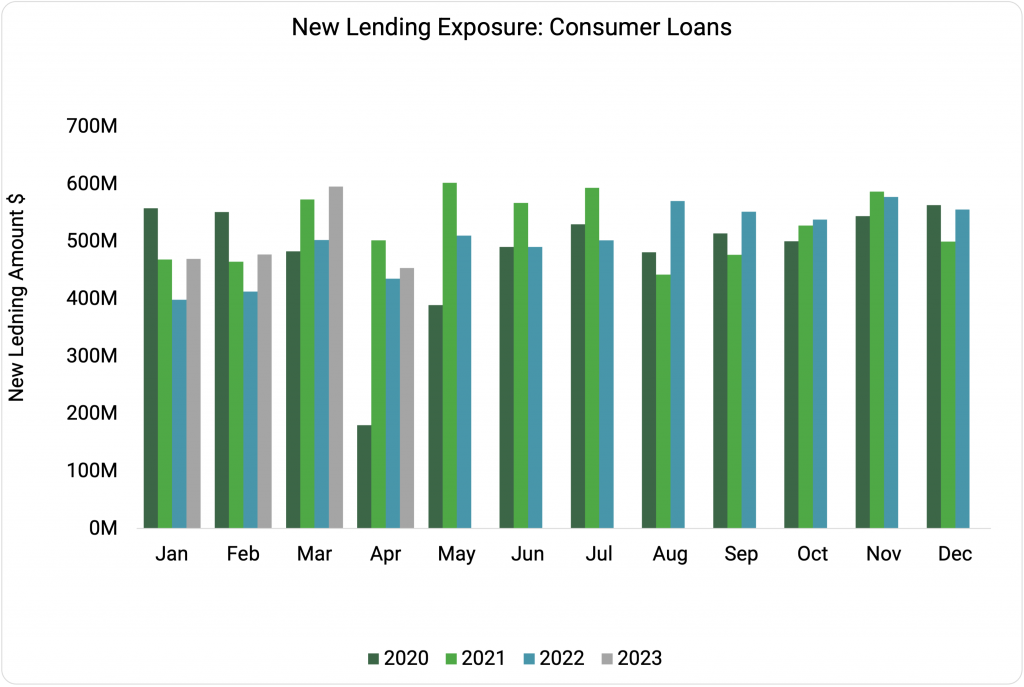

Mortgage lending down while consumer lending increases

Taking a look at the actual borrowing happening in Aotearoa New Zealand, we see new mortgage borrowing was down 28% year-on-year in April 2023, driven largely by record low property listings as the market remains relatively downturned.

On the other hand, non-mortgage lending was up marginally year-on-year (4.1%), largely driven by an increased growth in vehicle financing. Despite this, overall household borrowing was down 26% year-on-year.

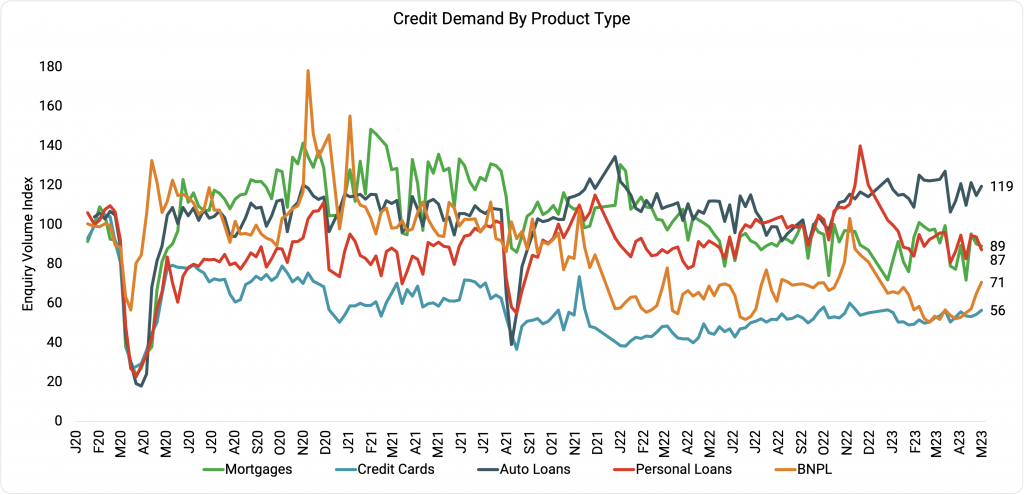

Demand for new credit products rose year-on-year in May 2023, led by an upswing in applications for credit cards, auto and personal loans, and energy utilities.

In line with actual lending, demand for new mortgages remained low with home loan applications down 13% year-on-year in May 2023 as the market remains cool.

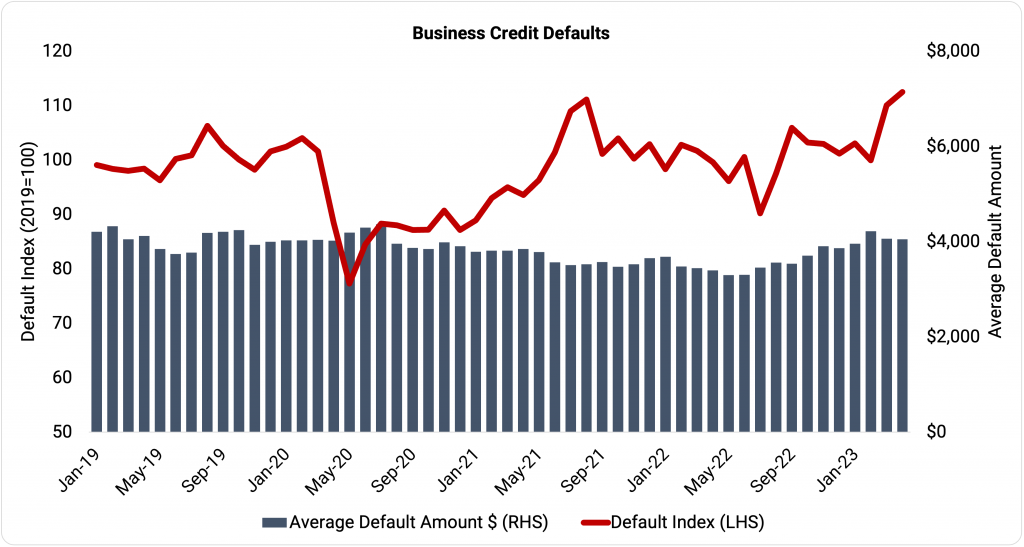

Kiwi businesses feeling the squeeze

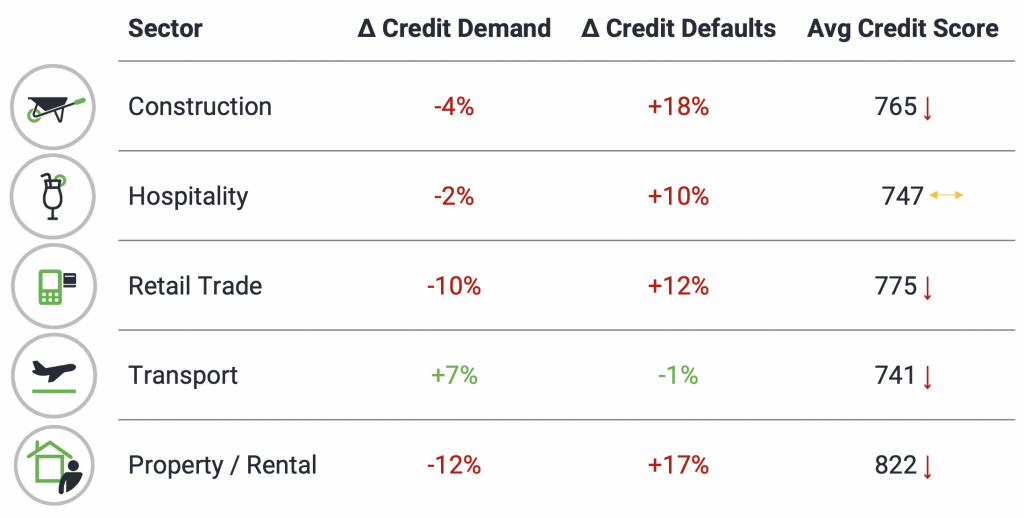

Turning to business credit trends, we see year-on-year credit defaults are up across all business sectors, except for transportation.

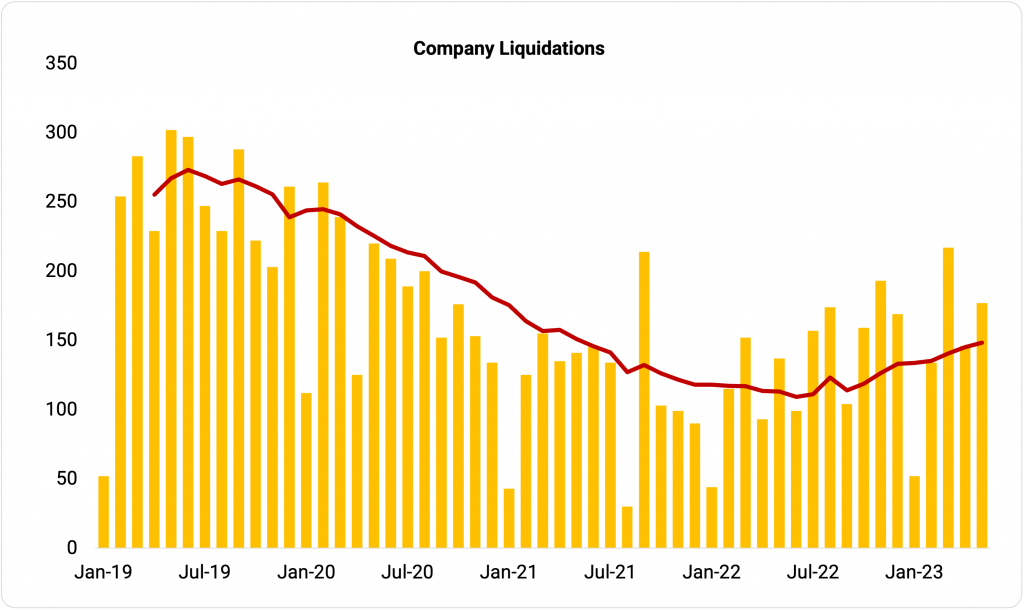

Overall, both business credit defaults and company liquidations are up year-on-year in May 2023, by 13% and 31% respectively.

The construction sector continues to battle against the current economic climate, with defaults up 18% year-on-year in April 2023 as firms contend with inflation and supply chain issues.

While it’s too early to tell if this is a sign of plateauing, it’s encouraging to see overall arrears growth slow for a month as people either get on top of their repayments or make arrangements with their creditors to get through these tough times.

On the flip side, it’s obvious the slowdown in consumer spending is hitting Kiwi businesses hard. While this is the overall goal of the Reserve Bank increasing OCR to help curb inflation, it remains a challenging time for business owners.

This is in the face of record low unemployment, with a tight labour market making putting pressure on businesses to retain employees while juggling their financial bottom line in the face of rising wage demands.

If the OCR remains level, the economic stage has been set for the remainder of 2023. Only time will tell how Kiwi households and businesses alike navigate the second half of the year.