Consumer Credit Falls Sharply as Auckland Enters New Lockdown

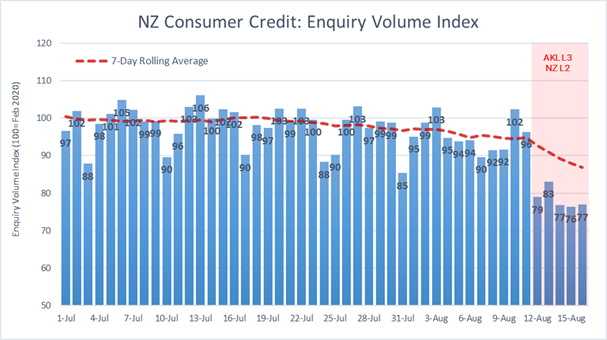

This week we released data showing new lockdown measures in Auckland have resulted in a sharp fall in the demand for consumer credit, with credit enquires falling by a quarter in just one week.

Centrix Managing Director Keith McLaughlin says the move to level three restrictions in Auckland saw credit enquiries fall by 25 percent when compared to the week previous.

“The new restrictions in Auckland have had an immediate impact, with large numbers of consumers disappearing from the market, closing their wallets and avoiding taking on new debt,” says McLaughlin.

“Outside of Auckland, we also saw a much more subdued credit market, with the demand for consumer credit falling by an average of 6 percent across almost all regions outside of Auckland.

“While Auckland was clearly the most impacted, credit demand also fell significantly in the Waikato, Bay of Plenty and Northland. There were also falls in credit demand in every other region across the country, with the exception of the West Coast and Manawatu-Wanganui, which saw only a very small uptick in credit demand.

“While it is still very early days, it is likely credit demand in Auckland has been impacted by the physical closure of many retail stores in the city, as well as consumers following guidelines and staying at home for the past few days.”

McLaughlin says credit demand is a good economic indicator as to what is happening in the wider economy.

“Following news of the latest outbreak we are also likely seeing increased nervousness around the continuing impact of COVID-19 on the wider economy and what this might mean for the employment market,” explains McLaughlin.

“When people are concerned about their jobs or their finances, it is perfectly natural for them to hit the pause button, limit their spending and avoid taking on any unnecessary debt. We can expect the credit market to remain subdued over the next couple of weeks until it becomes much clearer how large the current outbreak is and what the wider economic impact will be.”

McLaughlin says the latest downturn comes after consumer credit market had largely recovered from its previous collapse in March, when the country entered very tight level four lockdown restrictions.

“In May we saw a rapid recovery in consumer credit as Kiwis emerged from lockdown and hit the High Streets. This latest outbreak, however, will likely contribute to increased economic uncertainty that might leave many Kiwis feeling nervous about their own financial circumstances,” says McLaughlin

“For many, these are difficult economic times and we know that some New Zealanders will be finding themselves in financial difficulty. My advice to anyone in this situation who might be struggling to pay their bills, is to be proactive and take action.

“Ignoring your bills is never an option. Talk to the company you owe money to and discuss alternative arrangements to avoid downgrades to your credit score. Most companies understand the challenges consumers are facing and want to work with them through this period.

McLaughlin says Kiwis facing difficulties can also seek the services of a financial mentor to help them through.

“We’re committed to helping New Zealanders improve their financial literacy. That is why Centrix recently partnered with FinCap to provide financial mentors with free, comprehensive and real-time access to their client’s credit records. This helps FinCap mentors have better conversations with their clients to help them manage their finances,” says McLaughlin.

We release insight reports and data into credit demand frequently. If you with to receive our reports, sign up using the form on this page.

We’re here to help manage credit risk.