Your personal credit report is a summary of how often you’ve bought products or services on credit, and how well you’ve paid your bills on time.

It’s not just credit card, loan and mortgage information; the information in your consumer credit report is collected from multiple sources. Anyone who supplies goods or services to you and accepts payment later can be included in your credit report, such as phone companies and power companies; even some property managers may report if you pay your rent on time.

Also known as a consumer credit report, your credit report includes personal information about you, such as other names you are known by, and a list of recent addresses. It can also include payment history, ID verification, and company affiliation information if you’re a shareholder or director.

The report also features a credit score, which is a number between 0 and 1,000 that’s calculated based on how well you have paid your bills on time. The higher the score, the better your credit rating. If you’d like to understand how your credit score is calculated, and how you can improve it, click here.

Centrix consumer reports include the following information:

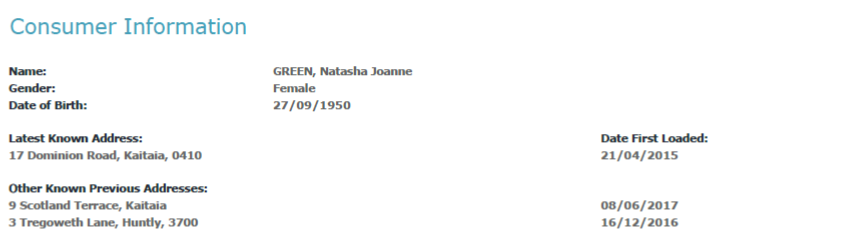

- Consumer Information

The report contains any unique information a potential creditor or employer might need to identify you, such as your name, address, and date of birth. If you have gone by previous names, or listed other addresses on your financial records, these are also shown.

Example report

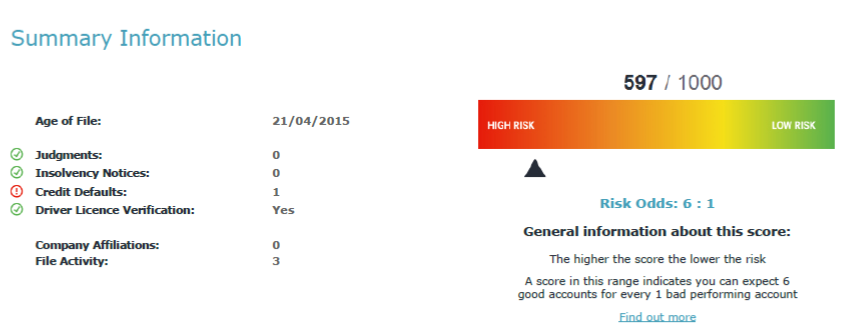

- Summary Credit Information and Credit Score

The summary section shows your recent credit history at a glance, including your current credit score, as well as any defaults, insolvencies and judgements, if applicable.

The credit score is a summary of the information in the report, which helps businesses to decide whether to loan you money or provide you goods and services on credit.

Example report

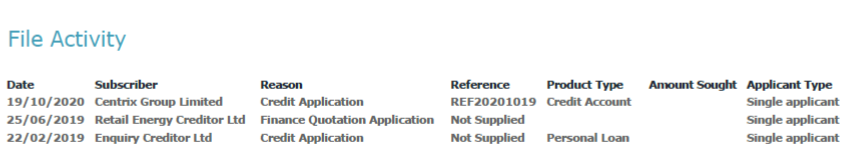

- File Activity

This is the number of credit enquiries, or how many times you have applied for credit, in recent years.

Example report

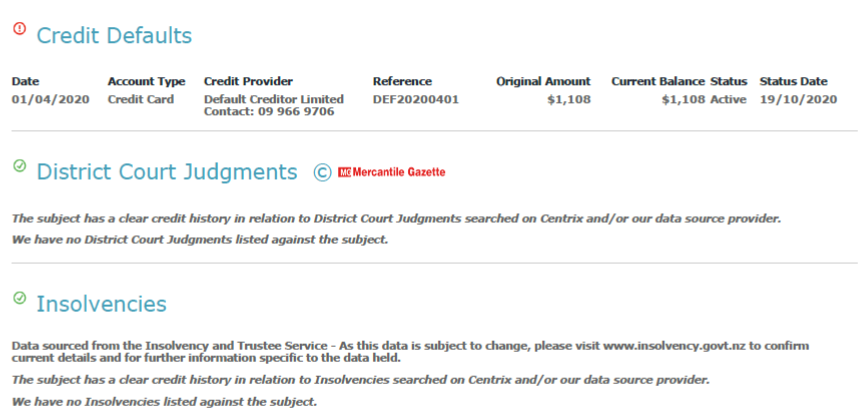

- Defaults, Judgements, and Insolvencies

All judgments and defaults are also included. This means that if you have failed to make payments to other companies who are credit providers, these details are listed here.

Example report

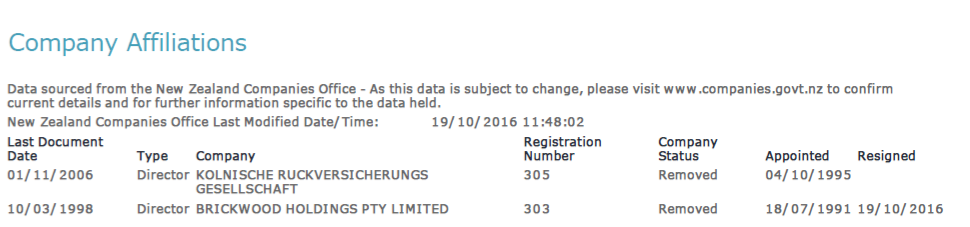

- Company Information

Any director or shareholder affiliations you have recorded at the Companies Office is reported, including general company information such as registered name, trading name and address.

Example report

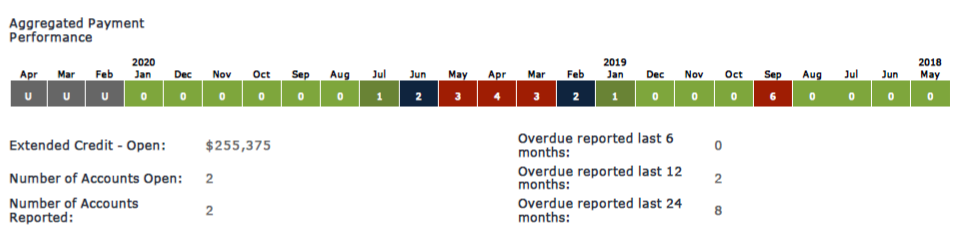

- Account Payment Information

Your detailed account payment information is included in some Centrix consumer reports, including the amount owed on account for each period, payments made on time, and overdue payments for each period.

Example report

How can I protect my information?

This information is available according to the terms of the Privacy Act 2020, and Centrix only shares your credit report information with businesses who meet the provisions of the Act. However, if your information is incorrect, or if you’ve been a victim of fraud, you can apply to amend or suppress your credit report.

Why are credit reports important?

Most New Zealand businesses credit check their customers before lending money to a business or consumer. Other people who might check your credit report include potential landlords, power companies, telco companies and employers.

High credit scores are usually assigned where you have a long active credit history and a very good payment history demonstrating you have a high level of financial stability. To find out how you can improve your credit score, click here.

Want to know your personal credit score? Click here to have your personal credit report sent to you for free.